DOMINION BOULEVARD CORRIDOR STUDY | Chesapeake, Virginia

28 | Market Study

Market Study | 29

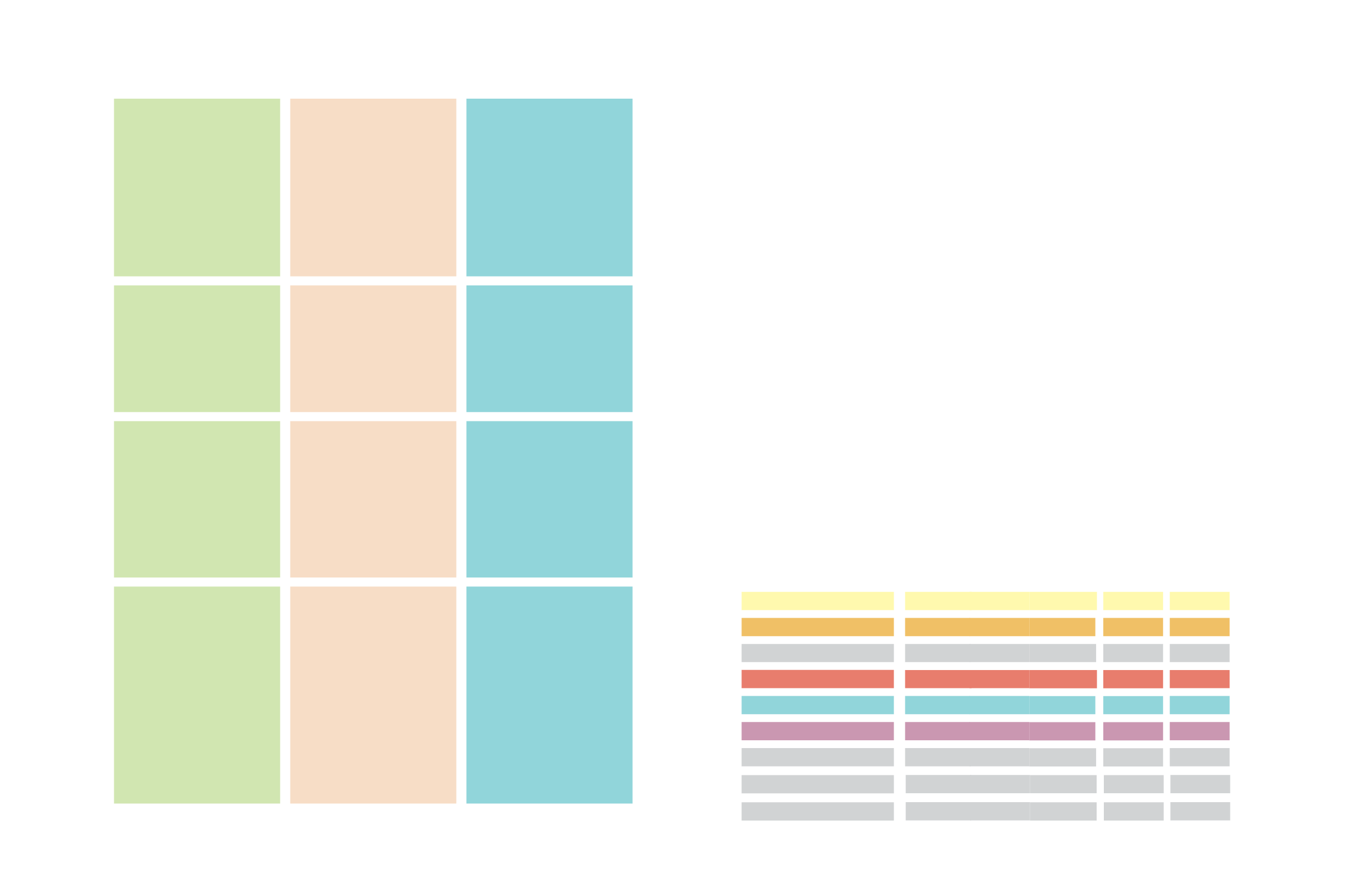

Table 2: Key Strengths, Challenges, and Opportunities in Dominion Study Area

Table 3: Regional Employment Center Scenario Summary

Regional Employment Center Scenario

The Study Area can become an employment center of

regional significance. It will need to have infrastructure

in place, the backing of the economic development

community, as well as strong amenities, executive

housing, and a wide range of land uses. It will be

critical to have the employment core as close to

the interstates and northern part of the Study Area

as possible. The City of Chesapeake may need to

catalyze the opportunity.

The majority of the available commercial, industrial

and office land uses should be concentrated in a

mixed use “employment core” that includes retail, high

density housing, parks, open spaces and community

services such as schools, police, fire, etc.

For-sale and for-rent projections for the Study Area

were based upon household growth in the MSA;

owner/renter propensity (approximately 67% owners);

Chesapeake’s capture of the MSA based upon capture

of MSA new home sales from 2009-2013; apartment

absorption from 2000-2013; the potential capture

based upon the desirability of the Study Area for

residential; as well as the availability of land. Retail

projections were based upon household growth in

the Study Area multiplied by 85 square feet of retail

per household (based upon the comparison of total

square feet of retail in the MSA compared to total

households). Office projections were based upon

employment growth in the MSA, total square feet of

office per new employee (250 sf/employee based

upon local costar data and national trends), and the

percent captured in the Study Area based upon it

becoming an employment center, performing similarity

to the Greenbiar submarket as it matures. Industrial

projections were based upon employment growth

in the MSA; total square feet of industrial per new

employee (500 sf/employee based upon local costar

data and national trends); and the percent captured in

the Study Area, capturing twice as much as the Deep

Creek Submarket currently captures.

The Regional Employment Center will offer

the characteristics that companies look for

- characteristics that include an attractive

streetscapes, a variety of restaurants, and

proximity to a young, talented workforce.

Companies have discovered that there is a

business advantage to locating close to their

employment base, and leading employers have

been following young, highly-skilled workers to

urban, amenity-filled neighborhoods. Nationally,

traditional business parks are facing high vacancy

rates with markets beyond the urban fringe in the

lowest demand. Companies relocating to more

vibrant, walkable neighborhoods is a strong trend.

By providing these types of neighborhoods and

environments, the Study Area should help attract

businesses to Chesapeake.

Land Use

Residential

Retail

Office

Industrial

Strengths

As Greenbrier builds out, the

opportunity to be the “next”

Greenbrier—although it can be

with today’s design standards and

guidelines

Once bridge is completed and road

widened, will create a new area for

development

In the mid- to long-term, the health

care industry should help bolster the

office market

For the near- and mid-term, the

regional and community shopping

needs of residents will be met at

Greenbrier area, limiting need for

certain types of retail

Industrial-related employment is

projected to decrease in the region

The Study Area is not as well-

positioned as other areas for some

types of industrial development—it

is not on the water, does not lead to

other major cities (e.g. along I-95) and

does not have rail access

There are not a lot of large parcels

of industrial land available in the

market—have enough land to be able

to accommodate larger users

Industrial development in this area

could serve the general industrial

needs of the region

All of the industrial buildings would be

new and meet the latest standards in

industrial building height clearance,

etc.

Tidewater Community College has

a new facility in the area—may be

possible to work with them for training

opportunities for future businesses

Widening of Dominion Boulevard and

opening of new bridge will make the

Study Area more desirable for future

office

The City of Chesapeake’s interest in

creating an employment center in the

Study Area will help it succeed

Development is already starting to

move in this direction

The office market is still struggling—

will not be a “leader” land use in the

Study Area without significant catalyst

Somewhat far off of interstate

access—a key to creating employment

cores—will need to work on the image

for access

Create new retail centers in “town

center” configurations that could help

create a sense of community and a

focal point for development

The retail market is relatively strong

and stable—could be a good use that

will be in demand in the short-term as

housing is created

Close to Great Dismal Swamp and

associated recreational opportunities

Chesapeake is a well-regarded place

to buy a home—the schools are good,

leading to strong housing demand

New Grassfield High School would be

attractive for new residents

Culpepper Landing, an actively selling

master-planned community with

the strongest sales in the region, is

already selling close to the Study Area

High-end housing in the region is

water-oriented. Will need to figure

out how to amenitize the residential

projects in the Study Area to compete

for executive housing

Without associated employment

development, would be difficult to build

multifamily residential

Create multiple master-planned

communities/neighborhoods,

appealing to a wide range of buyers

and renters

The for-sale residential market is

starting recovery, and this area, if

zoned for residential, would be a

strong location for development

Will be a good location for future

households, and therefore, future retail

to support it

Close to airport

Development is already starting to

move in this direction

Opportunities

Challenges

$400,000

$1.30

$16

$18

$6

$ / Unit / SF

For-Sale Residential

For-Rent Residential

Total Residential

Retail SF

Office SF

Industrial SF

Total SF Commercial

Yield Summary

2,278

448

2,726

240,319

233,693

114,859

588,871

2014-2024

1,871

579

2,450

214,722

482,966

28,273

725,961

4,148

1,027

5,176

455,041

716,659

143,133

1,314,832

2025-2035

Total to

2035

Estimated Employees

Jobs to Households

1,699

2,466

4,164

0.62

1.01

0.80

9,000

3,000

12,000

1,015,637

2,500,000

1,250,000

4,765,637

Build Out

14,757

1.23