DOMINION BOULEVARD CORRIDOR STUDY | Chesapeake, Virginia

22 | Market Study

Market Study | 23

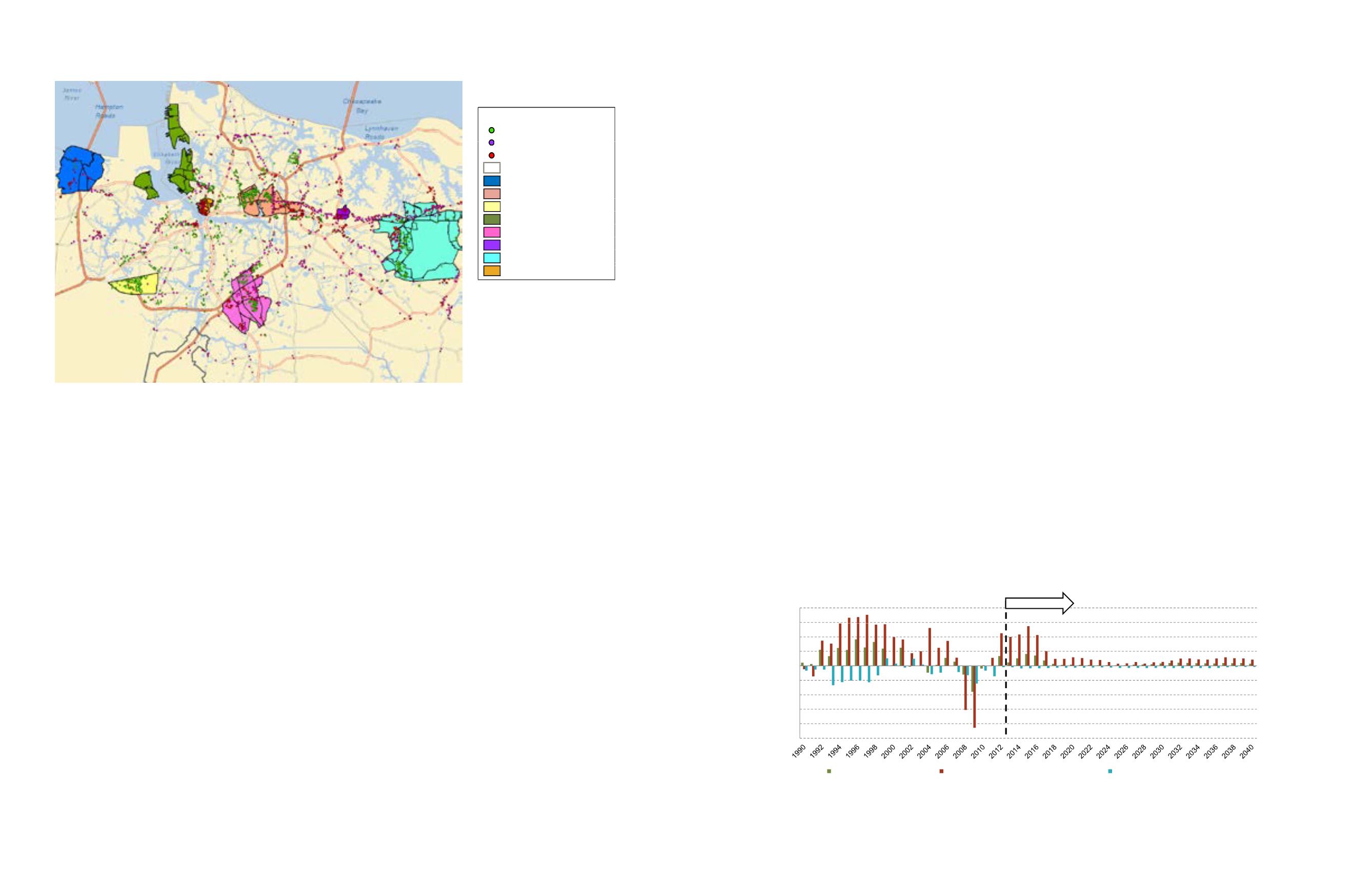

Hampton Roads Employment Growth

Like most of the United States, the Hampton Roads region was

significantly impacted by the Great Recession. Employment dropped,

home sales plummeted, and commercial vacancies rose. Most of the

sectors are in recovery, and the next few years should see better

performance in most of the real estate classes.

However, between 2020 and 2030, the growth will slow to 4,000 new

jobs annually. Their long-term projections do not take into account

major future recessions, but there are likely to be ups and downs in the

next 20 years.

The economic and demographic outlook for the region is projected to

be moderate for the next ten years. Between 2010 and 2020, Moody’s

projects that the MSA will add an average of 5,900 jobs annually.

As stated earlier, the Hampton Roads TPO projections are in-line with

Moody’s projections, but slightly more optimistic.

15 000

20,000

PROJECTED

Annual Employment Growth

Virginia Beach-Norfolk-Newport News, VA-NC MSA; 1990-2040

5 000

0

5,000

10,000

,

25 000

-20,000

-15,000

-10,000

- ,

- ,

Office Employment Growth

Total Employment Growth Excluding Military

Military Employment Growth

NOTE: This Data does not include military or government employment

Dominion Boulevard | City of Chesapeake | April 11, 2014 | E4-11982.40

26

Source: Moody’s Economy.com

Figure 9: Annual Employment Growth, Virginia Beach-

Norfolk-Newport News, VA-NC MSA; 1990-2040

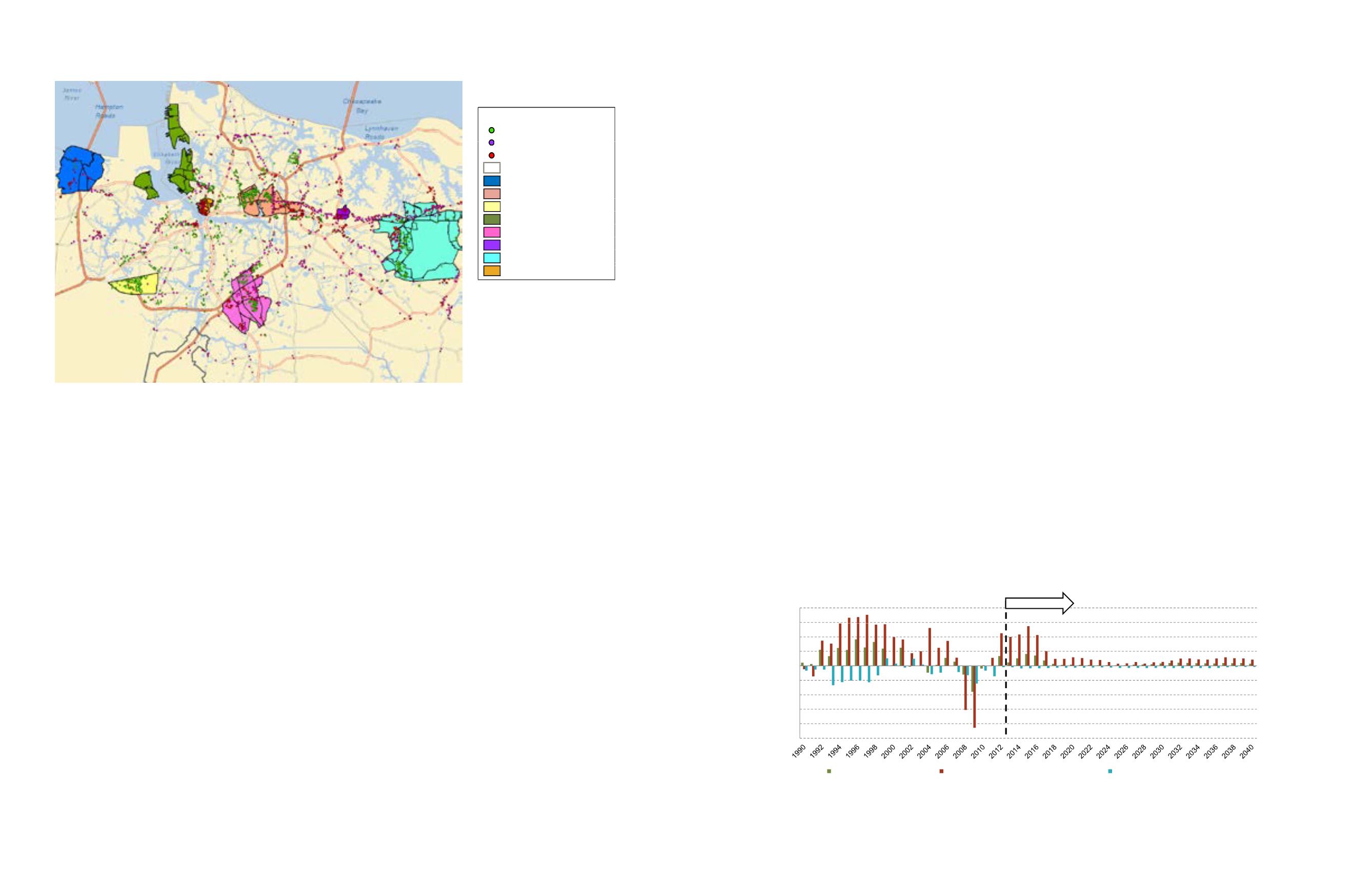

ncentrated on the seven employment cores

ct location of each of these cores is primarily

transportation routes, the unique topography

located in Exhibit V-15.

Approximately 30% of the current

employment base in the Hampton Roads region is contained

within these seven cores.

reas seemingly next to each other on a map,

s

ter

City of Chesapeake | April 11, 2014 | E4-11982.40

sri

of the region that divides areas seemingly next to each other on a map,

Map of Employment Cores

Hampton Roads Region

Industrial building

Offi

b ildi

MAP KEY

ce u ng

Retail building

Study Area

Harborview

Norfolk Ind. Park Area

Cavalier

Port Area

Greenbrier

Virginia Beach Town Center

Lynnhaven/Oceana

Downtown Norfolk

Dominion Boulevard | City of Chesapeake | April 11, 2014 | E4-11982.40

21

Source: RCLCO; CoStar; Esri

Figure 8: Map of Employment Cores

in the Hampton Roads Region

Source: RCLCO, CoStar

Household growth in the region is tied to

both primary home development related to

jobs and to retirement home growth which

is less dependent upon job growth. The

region is very attractive for both groups of

households given the relatively low cost of

living, good schools, nice climate, amenity

base, and location close to the ocean.

For-rent residential

The for-rent residential market is currently

very strong. Vacancies are low and rents

are increasing. There has been a lot of new

development recently in the rental market in

the region, so the opportunity for additional

short-term rental many not be as strong as

it was a few years ago. However, long-term,

the apartment market should remain strong.

The rental market includes both multifamily

rentals as well as single-family rentals.

The Chesapeake submarket and the

Hampton Roads region have historically

experienced balanced deliveries and

net absorption. From 2000 to 2013, the

submarket has, on average, delivered

150 units and absorbed a net of 133

units annually, capturing 9% of rental

absorption in the region. The Chesapeake

submarket absorbed 418 units in 2011 and

delivered 523 units in 2012, both marking

the highest levels in at least two decades.

The submarket’s capture of regional rental

absorption also reached a record high of

over 30% in 2012, though the long term

trend points to future capture at around

10% to 15%. Chesapeake, like much of the

region, is experiencing healthy vacancies

and rental rates. Though the submarket

does not command rents as high as

Kempsville and Lynnhaven, it is located near

the more expensive areas and has room to

grow. See Figure 11.

Key Findings - Market

While completing a long-term forecast for

an area over a 20+ year horizon, the current

state of the market is not as critical as with

a development project that is slated to start

and be finished within a five-year timeframe.

However, understanding the current

market provides us with the opportunity to

understand where the study area fits into the

region, as well as provide an understanding of

short-term opportunities.

sales. The number of total sales rose nearly

10% from 2011 to 2012 and 14% from 2012

to 2013. New home sales as a percentage

of total sales has steadily declined since

2004 from 34% to 15%. Both sales pace

and median price show clear increases

from 2012 and indicate growth and recovery

in the new for-sale housing market. See

Figure 5.

For-sale residential

The for-sale residential market is slowly

recovering from the Great Recession. Home

prices are up and inventory is down. The

Hampton Roads region still has a large

number of foreclosures to work through the

system. However, all indicators point to a

continued recovery, and long-term health in

the for-sale market. For-sale housing also

represents a strong short-term opportunity

in the study area.

The Hampton Roads housing market has

been slow to recover from the recession.

After a rapid rise in median existing single-

family home prices in the early 2000s, the

market hit a bottom in 2012 and only began

to see meaningful gains in 2013. The volume

of total home sales remained stagnant from

2008 through 2011, averaging 17,500 annual