Market Study | 25

Long-term, the growth in Professional and

Business Services and Health Services as

well as other office-oriented employment will

help bolster the office market.

The office market in the VA Beach MSA

has only recently begun to recover from

a dramatic contraction from 2008 through

2011. From 2006 to 2013, the average

annual office absorption was only half

the volume of office space delivered in

the MSA. Construction activity dipped to

150,000 square feet in 2012 (less than 10%

of the highest annual completion levels

before the downturn). Net absorption was

close to -500,000 square feet in 2011. The

market appears to be improving, showing

a promising uptick in both absorption,

completions, occupancy, and rent growth in

2013. See Figure 12.

Industrial

The Hampton Roads region is unique in that

it has almost double the amount of industrial

space (96M SF) than office space (48M SF).

The industrial market is performing relatively

Figure 11: Apartment

Submarket Absorption

Capture, Chesapeake

and Norfolk/Hampton

Roads Region; 2000-

2013 Source: Reis

well with only 8% vacancy rates and rental

rates close to $5/nnn SF. The challenge

for future industrial is that the types of

jobs that lead to industrial development

(Manufacturing, Trade) are expected to

decrease. Manufacturing is expected to

increase after the large losses from 2001-

2010, but Trade, Transportation, and Utilities

is expected to decrease for the foreseeable

future. Opportunities in industrial are tied

to the obsolescence of old buildings, and

finding niche opportunities.

At the MSA level, the industrial market had

a challenging 2013 after a brief recovery

from the recession. Average industrial rents

and occupancy appeared to bottom in 2010,

at $4.50 and 90%. The market delivered a

total of over a million square feet of industrial

space over the two years, allowing rent and

vacancy to recover to nearly 2007/2008

levels. Vacancy has continued to drop from

the high in 2009. In 2013, however, the MSA

experienced net negative absorption. Rents

have slipped slightly from $4.90 in 2010

down to $4.60 in 2013.

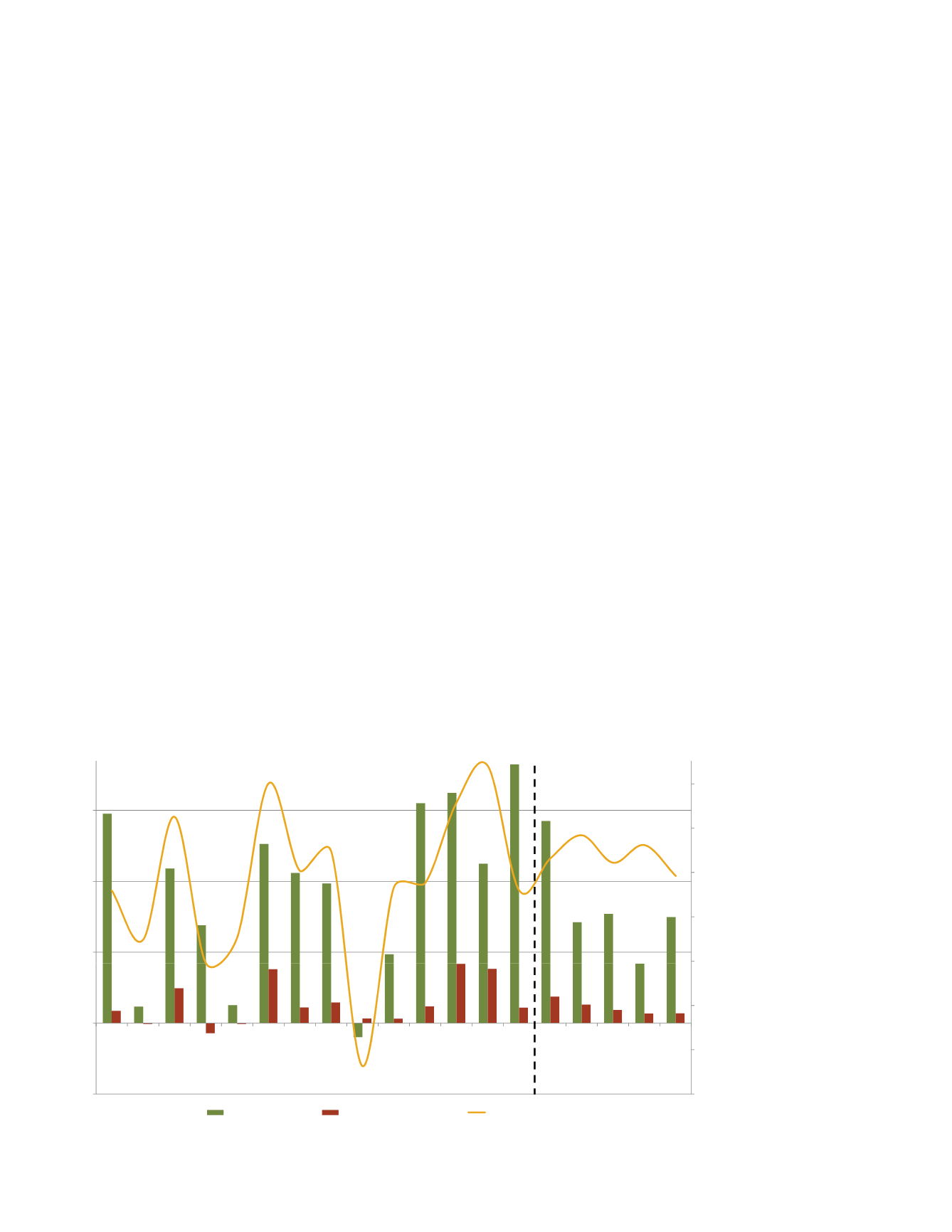

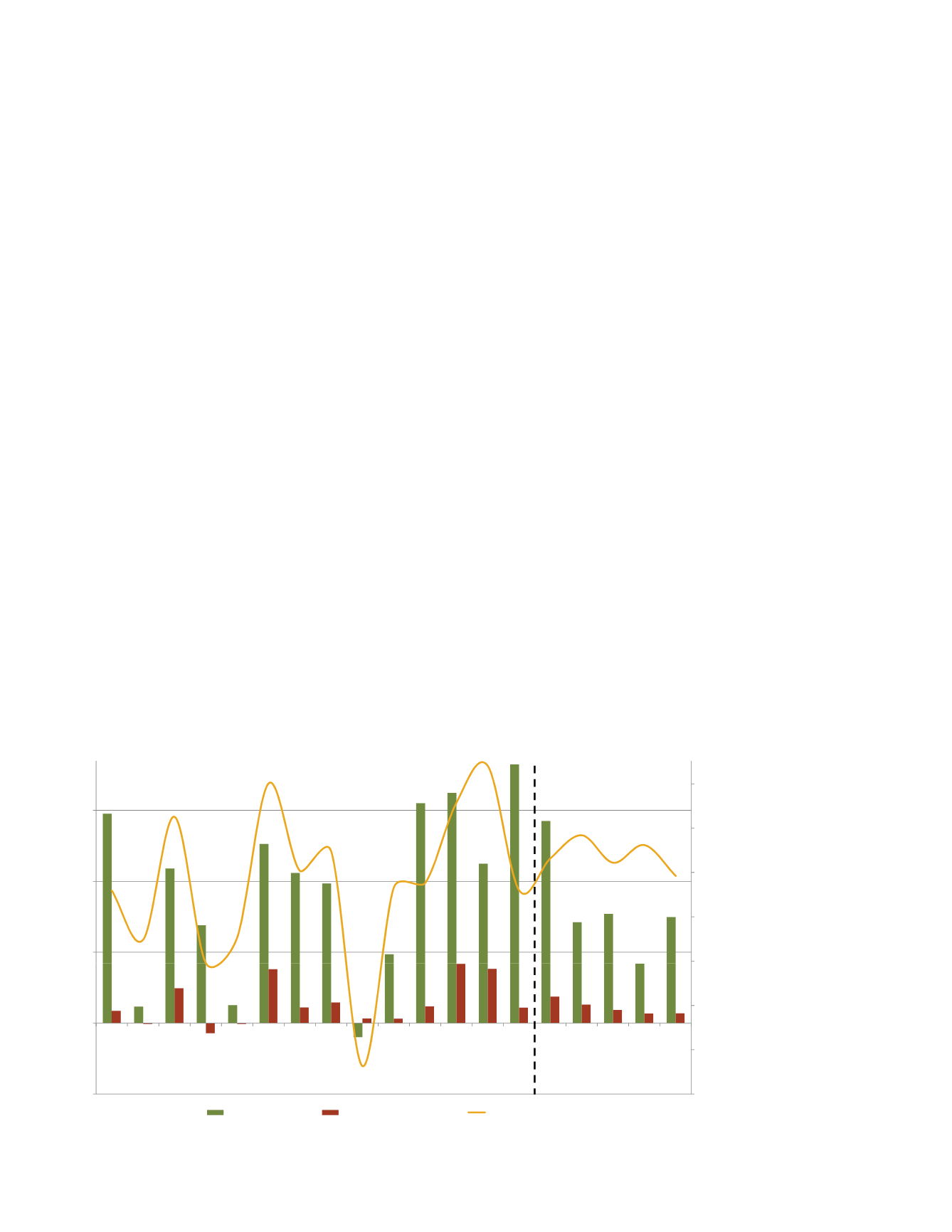

Exhibit III-5

CHESAPEAKE SUBMARKET CAPTURE OF NORFOK-HAMPTON ROADS APARTMENT ABSORPTION

CHESAPEAKE AND NORFOLK-HAMPTON ROADS REGION

2000-2018

-10%

0%

10%

20%

30%

40%

500

1,000

1,500

2,000

PROJECTED

2000-2013 AVG. CAPTURE:

9%

SOURCE: REIS

-40%

-30%

-20%

-500

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Metro Absorption

Chesapeake Absorption

% Capture of Region

Exhibit III-5

E4-11982.40

Printed: 3/27/2014

ITY OF CHESAPEAKE