DOMINION BOULEVARD CORRIDOR STUDY | Chesapeake, Virginia

22 | Market Study

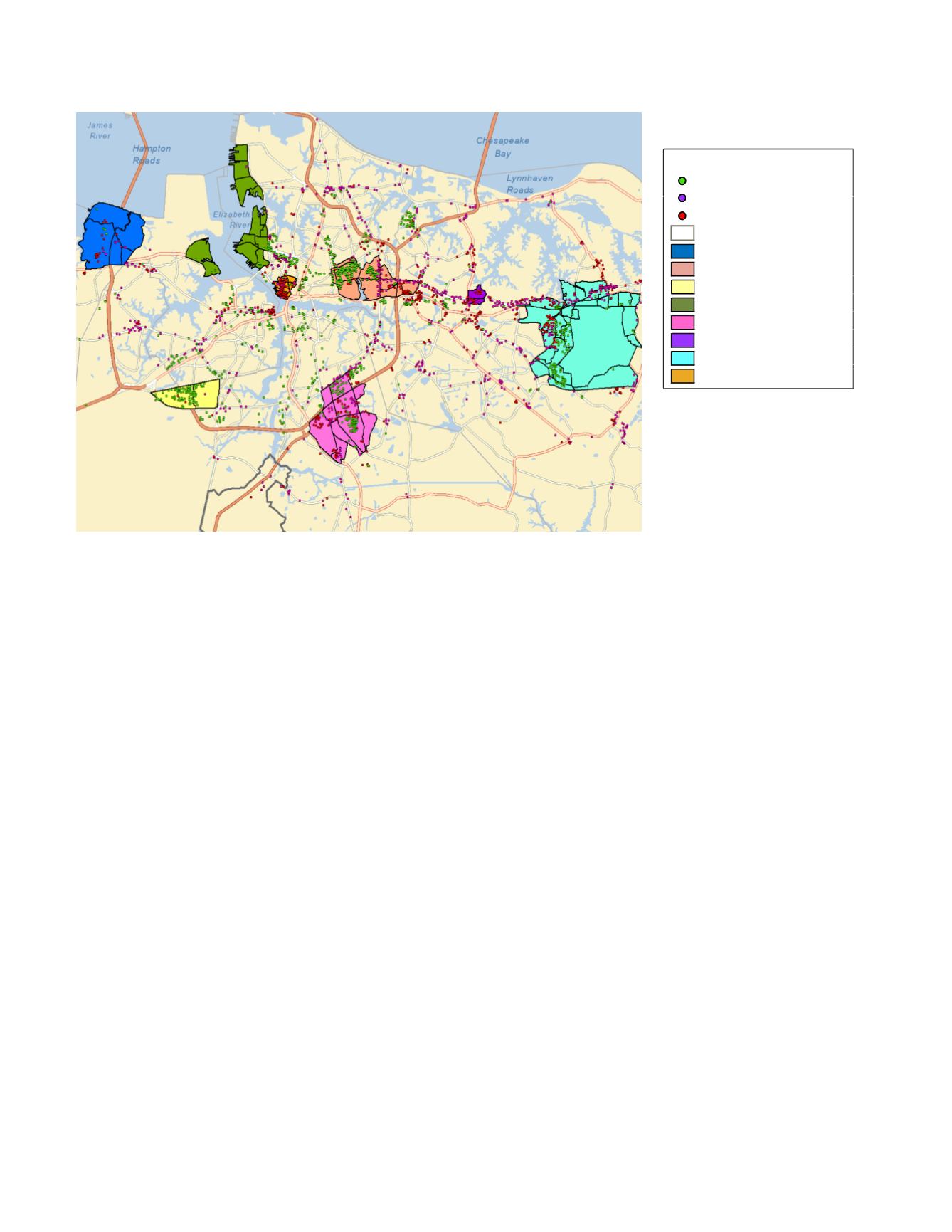

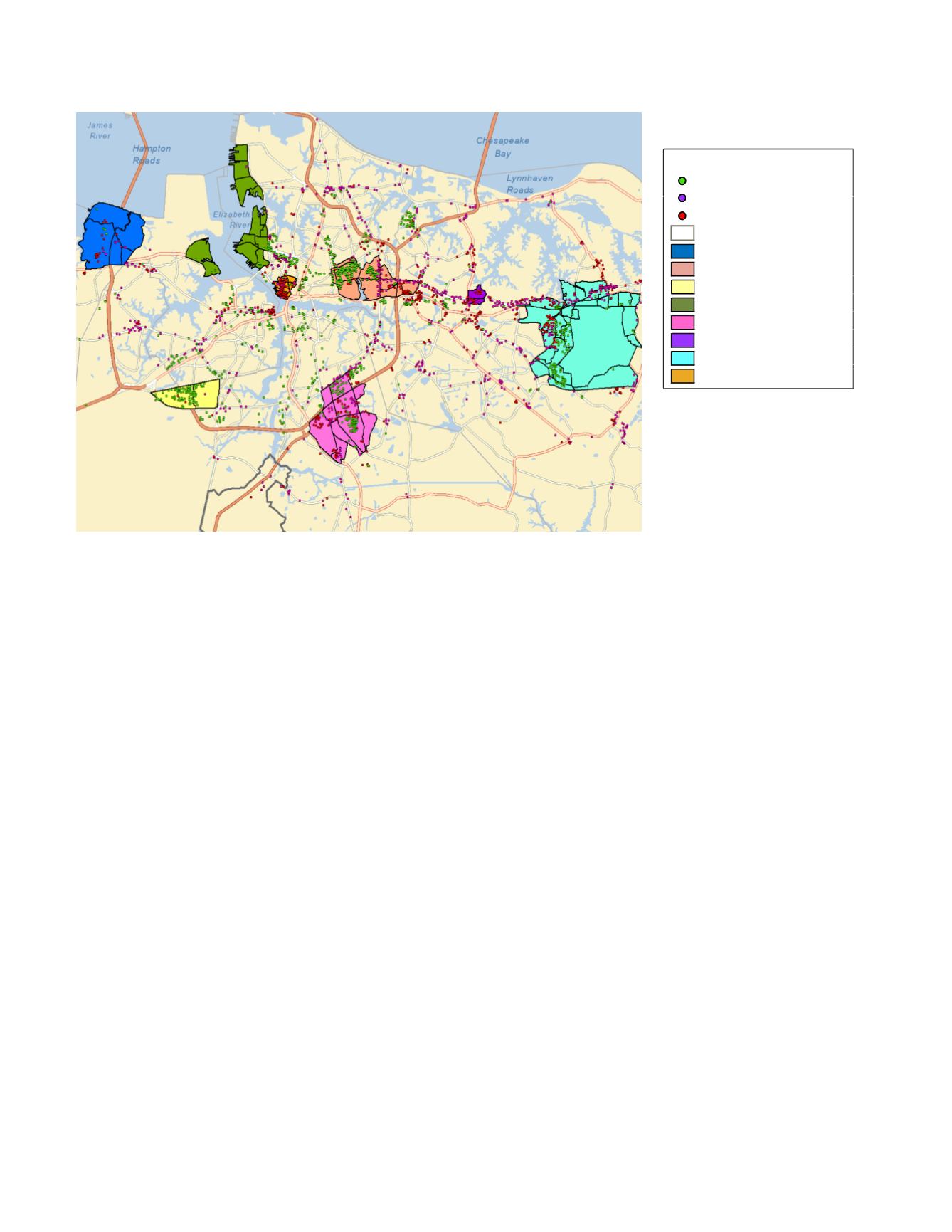

ncentrated on the seven employment cores

ct location of each of these cores is primarily

transportation routes, the unique topography

located in Exhibit V-15.

Approximately 30% of the current

employment base in the Hampton Roads region is contained

within these seven cores.

reas seemingly next to each other on a map,

s

ter

City of Chesapeake | April 11, 2014 | E4-11982.40

sri

of the region that divides areas seemingly next to e

Map of Employment Cores

Hampton Roads Region

Industrial building

Offi

b ildi

MAP KEY

ce u ng

Retail building

Study Area

Harborview

Norfolk Ind. Park Area

Cavalier

Port Area

Greenbrier

Virginia Beach Town Center

Lynnhaven/Oceana

Downtown Norfolk

Dominion Boulevard | City of Chesapeake |

21

Source: RCLCO; CoStar; Esri

Figure 8: Map of Employment Cores

in the Hampton Roads Region

Source: RCLCO, CoStar

Household growth in the region is tied to

both primary home development related to

jobs and to retirement home growth which

is less dependent upon job growth. The

region is very attractive for both groups of

households given the relatively low cost of

living, good schools, nice climate, amenity

base, and location close to the ocean.

Key Findings - Market

While completing a long-term forecast for

an area over a 20+ year horizon, the current

state of the market is not as critical as with

a development project that is slated to start

and be finished within a five-year timeframe.

However, understanding the current

market provides us with the opportunity to

understand where the study area fits into the

region, as well as provide an understanding of

short-term opportunities.

For-sale residential

The for-sale residential market is slowly

recovering from the Great Recession. Home

prices are up and inventory is down. The

Hampton Roads region still has a large

number of foreclosures to work through the

system. However, all indicators point to a

continued recovery, and long-term health in

the for-sale market. For-sale housing also

represents a strong short-term opportunity

in the study area.

The Hampton Roads housing market has

been slow to recover from the recession.

After a rapid rise in median existing single-

family home prices in the early 2000s, the

market hit a bottom in 2012 and only began

to see meaningful gains in 2013. The volume

of total home sales remained stagnant from

2008 through 2011, averaging 17,500 annual