Market Study | 23

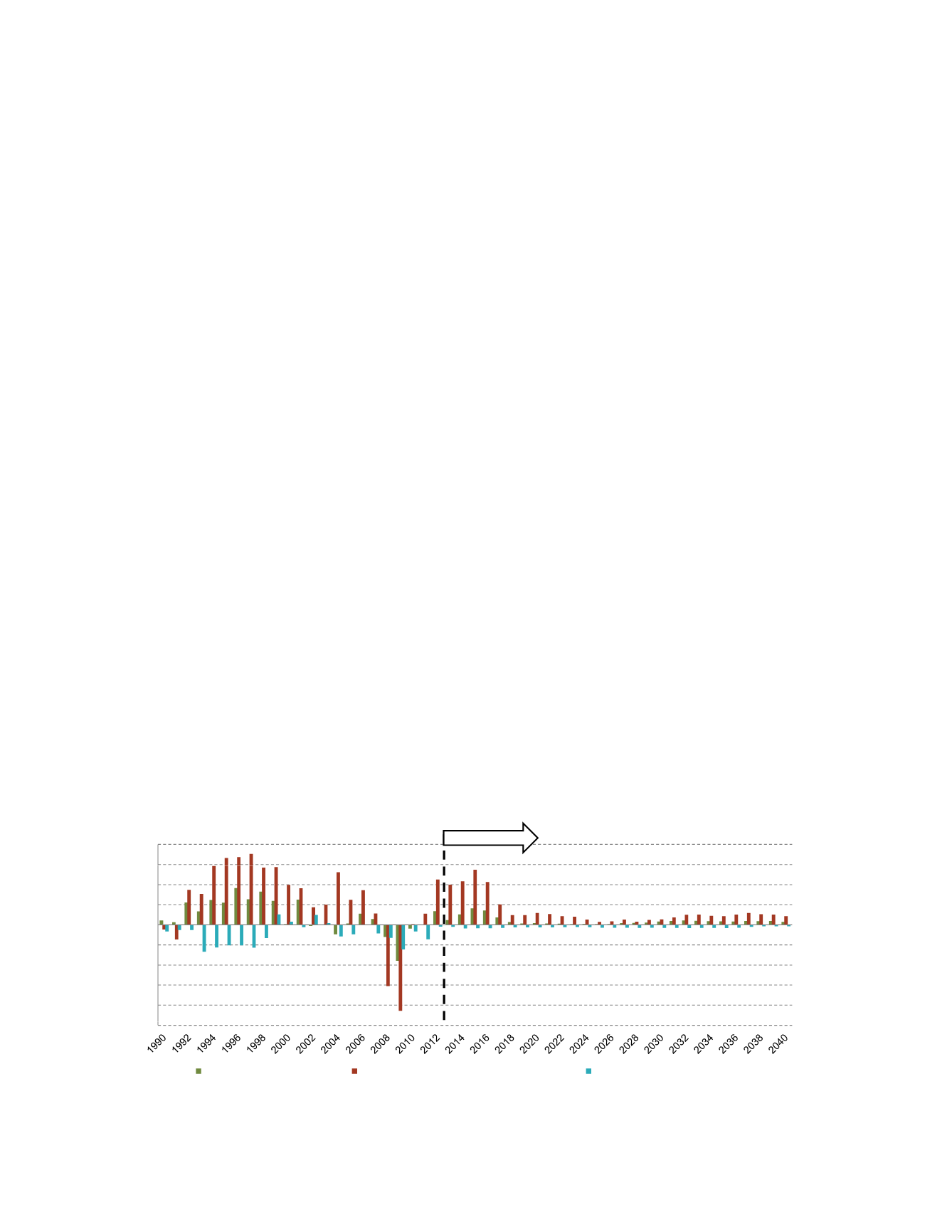

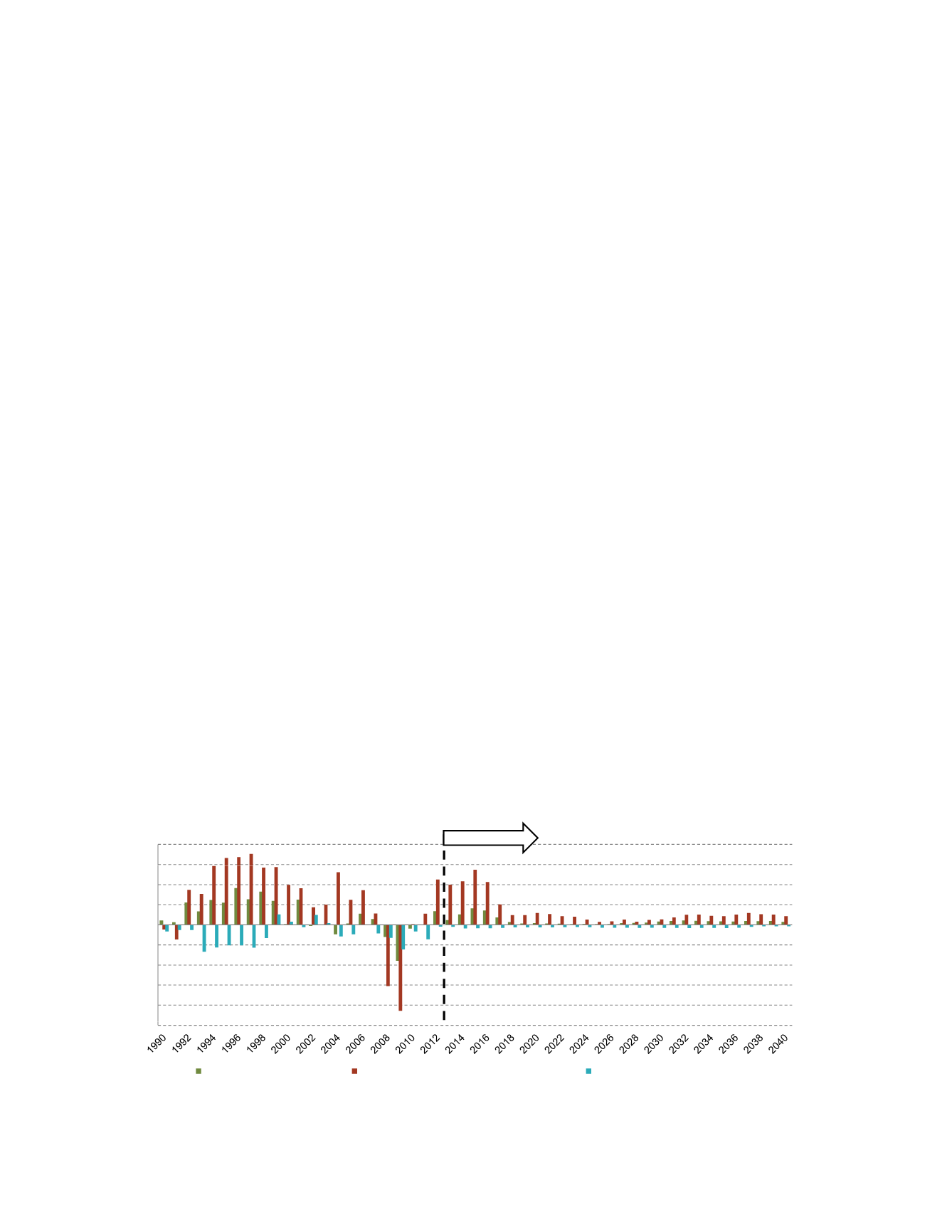

Hampton Roads Employment Growth

Like most of the United States, the Hampton Roads region was

significantly impacted by the Great Recession Employment dropped,

home sales plummeted, and commercial vacancies rose Most of the

sectors are in recovery, and the next few years should see better

performance in most of the real estate classes

However, between 2020 and 2030, the growth will slow to 4,000 new

jobs annually Their long-term projections do not take into account

major future recessions, but there are likely to be ups and downs in the

next 20 years

The economic and demographic outlook for the region is projected to

be moderate for the next ten years Between 2010 and 2020, Moody’s

projects that the MSA will add an average of 5,900 jobs annually

As stated earlier, the Hampton Roads TPO projections are in-line with

Moody’s projections, but slightly more optimistic

15 000

20,000

PROJECTED

Annual Employment Growth

Virginia Beach-Norfolk-Newport News, VA-NC MSA; 1990-2040

5 000

0

5,000

10,000

,

25 000

-20,000

-15,000

-10,000

- ,

- ,

Office Employment Growth

Total Employment Growth Excluding Military

Military Employment Growth

NOTE: This Data does not include military or government employment

Dominion Boulevard | City of Chesapeake | April 11, 2014 | E4-11982 40

26

Source: Moody’s Economy.com

Figure 9: Annual Employment Growth, Virginia Beach-

Norfolk-Newport News, VA-NC MSA; 1990-2040

For-rent residential

The for-rent residential market is currently

very strong. Vacancies are low and rents

are increasing. There has been a lot of new

development recently in the rental market in

the region, so the opportunity for additional

short-term rental many not be as strong as

it was a few years ago. However, long-term,

the apartment market should remain strong.

The rental market includes both multifamily

rentals as well as single-family rentals.

The Chesapeake submarket and the

Hampton Roads region have historically

experienced balanced deliveries and

net absorption. From 2000 to 2013, the

submarket has, on average, delivered

150 units and absorbed a net of 133

units annually, capturing 9% of rental

absorption in the region. The Chesapeake

submarket absorbed 418 units in 2011 and

delivered 523 units in 2012, both marking

the highest levels in at least two decades.

The submarket’s capture of regional rental

absorption also reached a record high of

over 30% in 2012, though the long term

trend points to future capture at around

10% to 15%. Chesapeake, like much of the

region, is experiencing healthy vacancies

and rental rates. Though the submarket

does not command rents as high as

Kempsville and Lynnhaven, it is located near

the more expensive areas and has room to

grow. See Figure 11.

sales. The number of total sales rose nearly

10% from 2011 to 2012 and 14% from 2012

to 2013. New home sales as a percentage

of total sales has steadily declined since

2004 from 34% to 15%. Both sales pace

and median price show clear increases

from 2012 and indicate growth and recovery

in the new for-sale housing market. See

Figure 5.